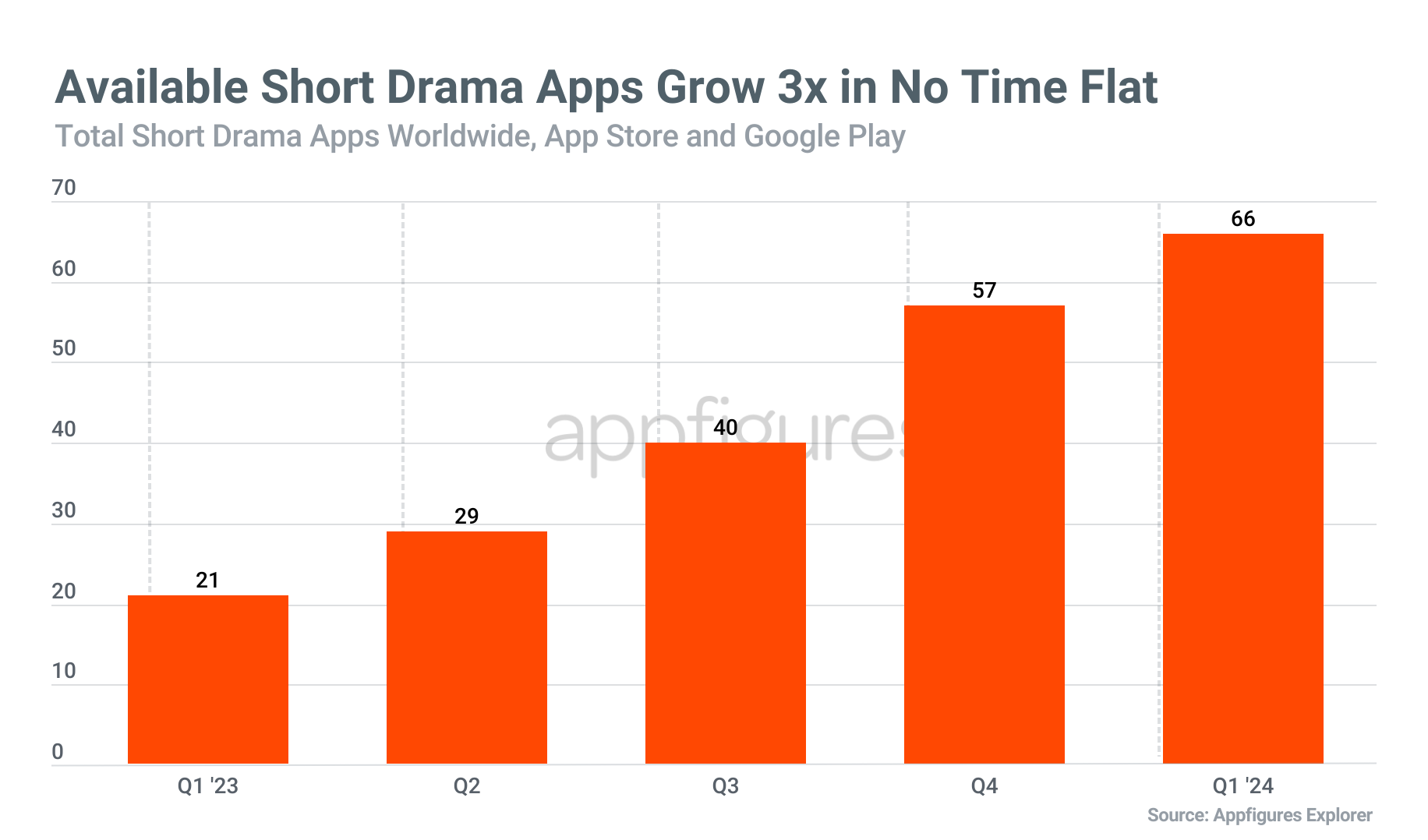

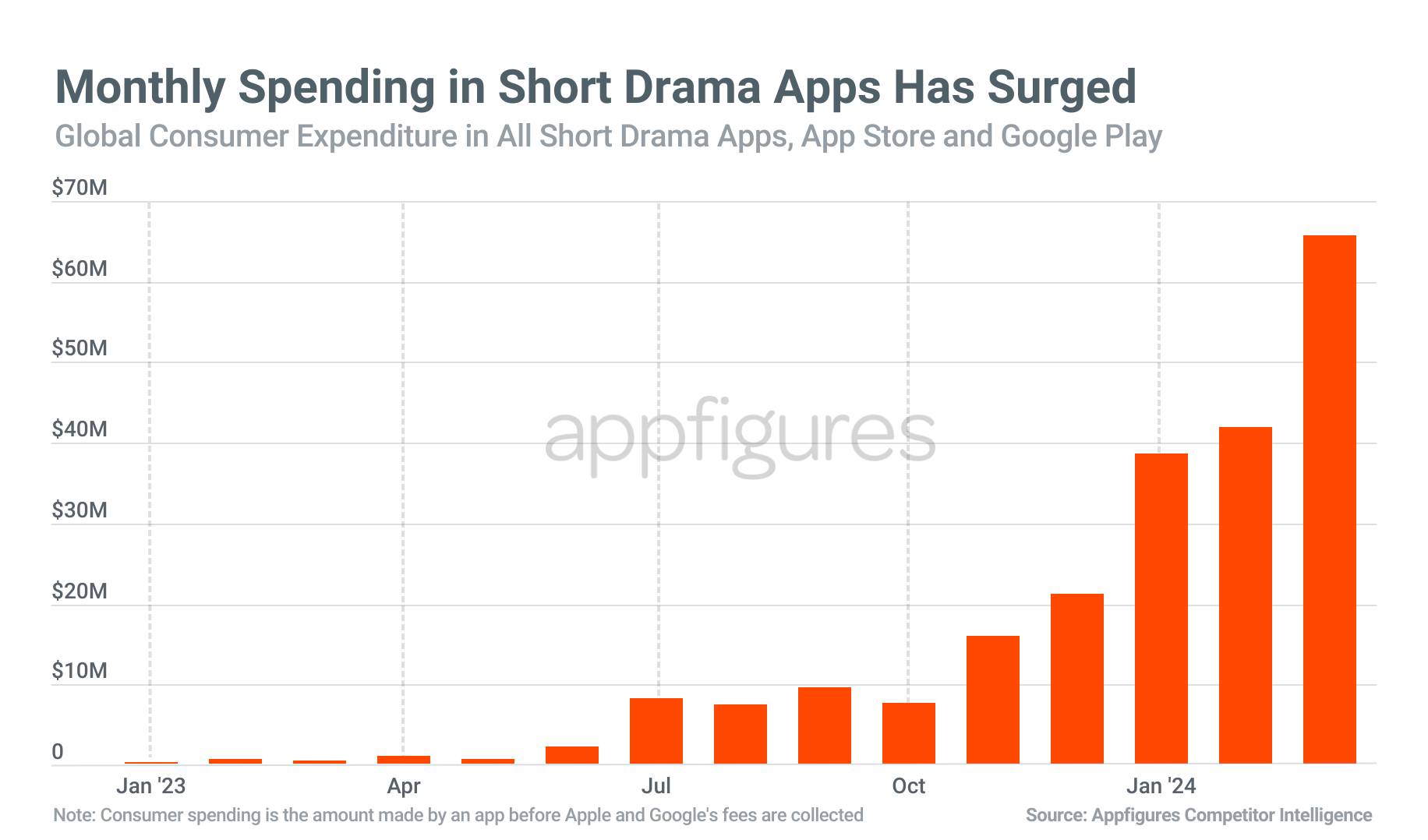

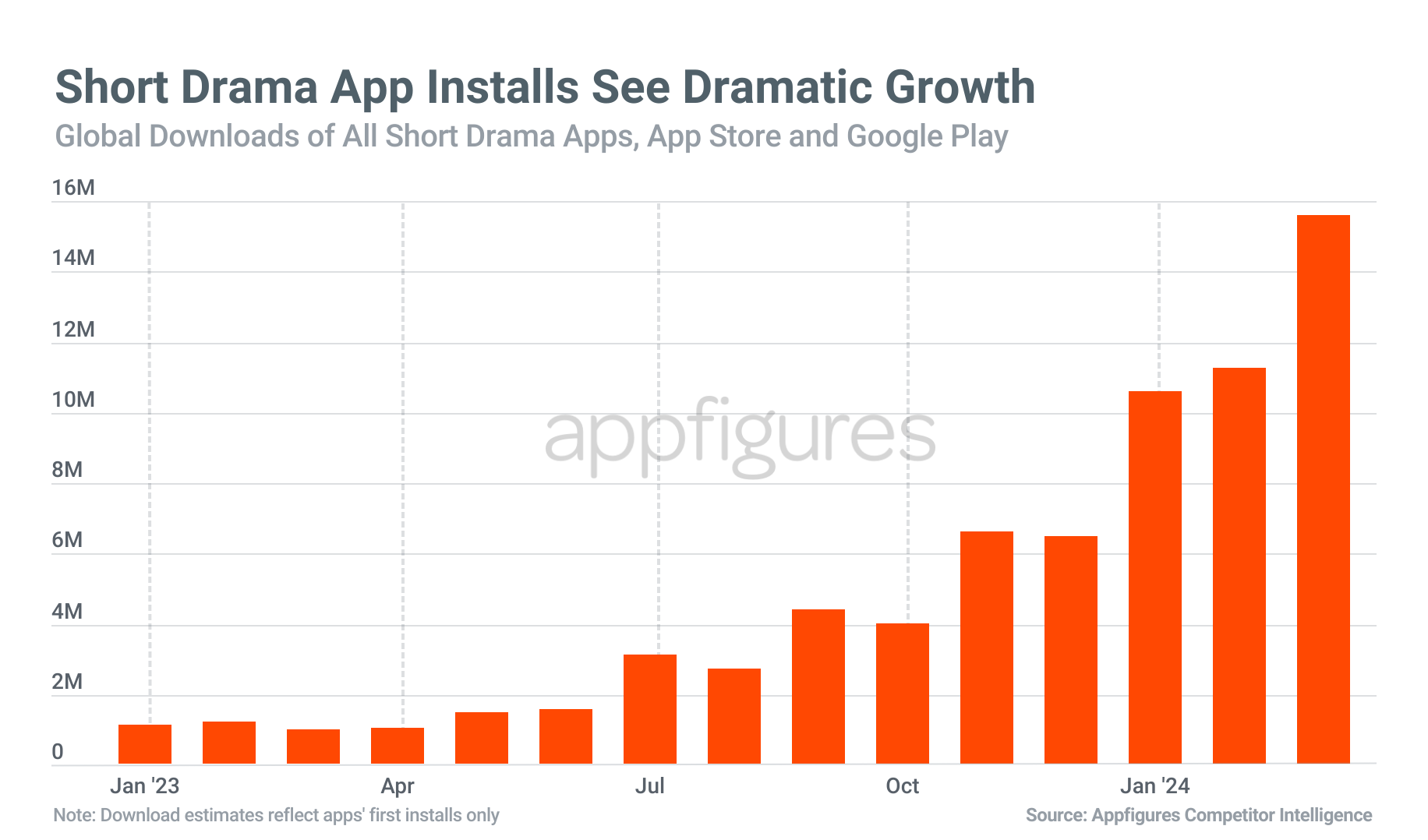

Could Quibi have been ahead of its time? Founder Jeffrey Katzenberg attributed the failure of the short-form video app to the COVID-19 pandemic, but recent data suggests that the concept Quibi introduced — original shows in short clips for quick entertainment — is having a resurgence. In the first quarter of 2024, 66 short drama apps like ReelShort and DramaBox collectively earned $146 million in global consumer spending, marking a significant increase from the $1.8 million revenue in the same period in 2023. Data from app intelligence firm Appfigures shows that with the addition of 45 more apps, the market has seen robust growth with approximately $245 million in gross consumer spending and 121 million downloads.

In March 2024 alone, consumers spent $65 million on these short drama apps, a remarkable 10,500% increase from the $619,000 spent in March 2023.

Image Credits: Appfigures

The shift towards growth began in fall 2023, according to Appfigures data, resulting in a substantial revenue increase between February and March 2024, with global revenue surging by 56% to $65.7 million from $42 million. The rise in revenue is attributed not only to the increased number of available apps but also to marketing efforts, advertising spending, and consumer interest.

Leading the revenue charts are ReelShort (No. 1) and DramaBox (No. 2), which generated $52 million and $35 million in Q1 2024, respectively. These two apps accounted for around 37% and 24% of the revenue from the top 10 apps, showing the market’s consolidation. ShortTV ranked third, grossing $17 million globally in Q1, constituting 12% of the total revenue.

Unlike Quibi’s attempt to establish a presence in this sector, the distinguishing factor of these new apps lies in the quality of content—though not necessarily in a positive way. Dubbed by TechCrunch as resembling “snippets from low-quality soaps” or mobile storytelling games brought to life, the storylines in these apps fall short of high standards. Despite the subpar acting and writing, these apps have managed to attract an audience.

Image Credits: Appfigures

According to data, the U.S. leads both in installations and revenue among the top markets for these apps. However, the distribution of downloads and revenue vary across different countries. While the U.S. is a key market in terms of downloads, countries such as Indonesia, India, the Philippines, and Brazil also feature prominently. Countries like the U.K., Australia, Canada, and the Philippines stand out as top markets in revenue generation, in addition to the U.S.

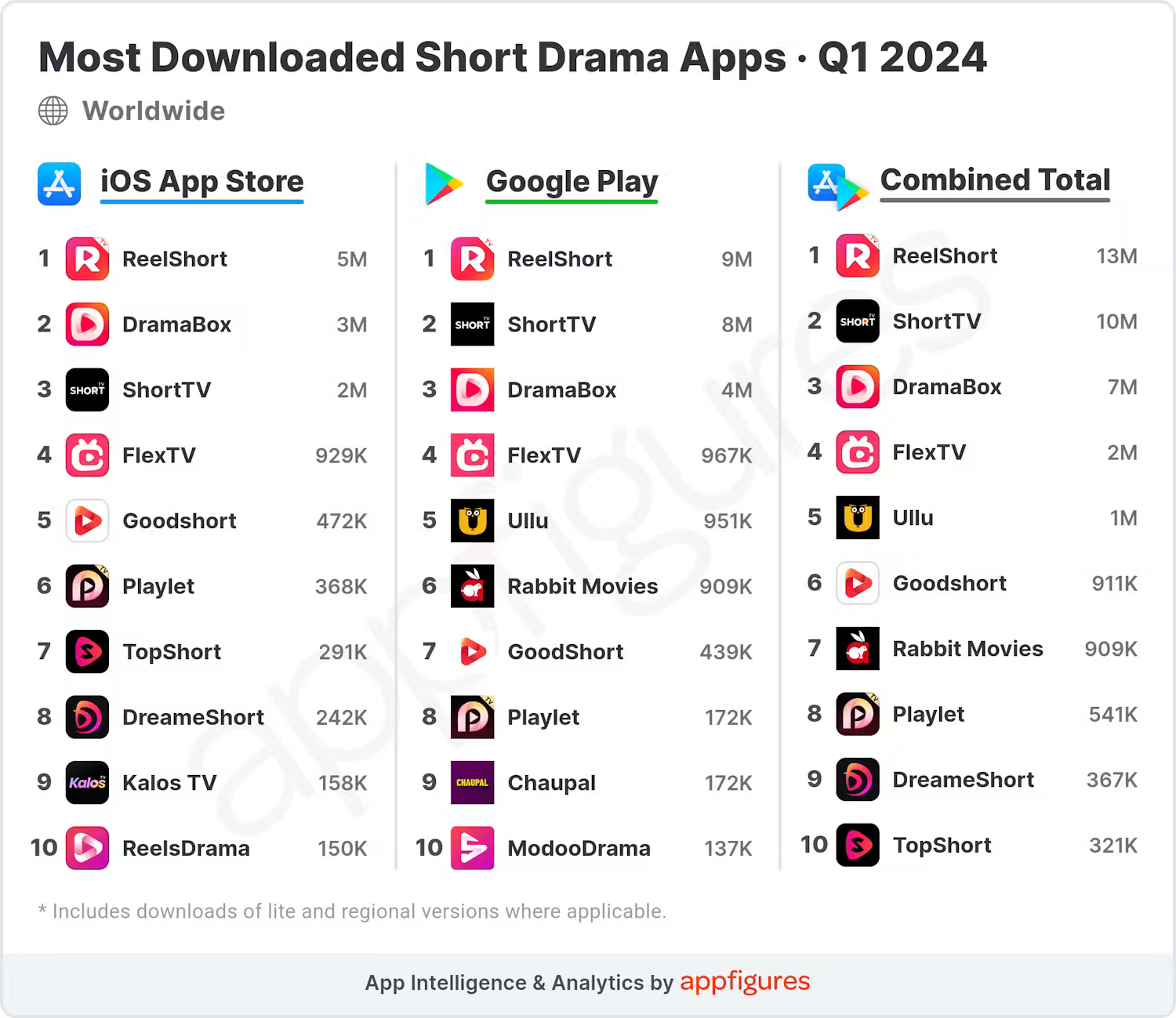

In Q1 2024, these short drama apps saw nearly 37 million installations, marking a 992% increase from 3.4 million in Q1 2023. ReelShort and ShortTV were the most installed, with the former accounting for 37% (13.3 million) and the latter for 27% (10 million) of installs. DramaBox, holding the second position in consumer spending, followed with 7 million (19%) installations.

Image Credits: Appfigures

Reflecting broader app store trends, iOS generated 63% of the revenue, while Android dominated with 67% of the downloads.

Although these young apps are seeing growth, they are still dwarfed by competitors like short-form video and streaming platforms. Short drama apps constitute only a 6.7% share of the total revenue across all three categories, a jump from 0.15% a year earlier. In contrast, the combined top 10 apps in all three categories, including heavyweights like TikTok and Disney+, earned $1.8 billion in Q1.

Image Credits: Appfigures

Image Credits: Appfigures